Sovereignty Insights

Stress Test : Structural propagation of a Venezuelan shock through the global economy

What is the actual exposure of European Union countries to such a shock, once the observed economic structures are taken into account?

Economic Analyst Note

Structural propagation of a Venezuelan shock through the global economy

1. Context and motivation of the analysis

This January 2026, international news was marked by a major event in Venezuela.

President Nicolás Maduro was apprehended during an operation conducted by U.S. forces and is expected to appear before a federal court in New York, notably on charges related to drug trafficking and narcoterrorism.

Independently of any political or judicial assessment, this event raises a precise economic question:

To what extent can a political shock affecting a producing and exporting country propagate, mechanically, through the global economy?

More specifically:

What is the actual exposure of European Union countries to such a shock, once the observed economic structures are taken into account?

This note aims to answer these questions exclusively on the basis of data, without behavioral assumptions, forward-looking scenarios, or macroeconomic extrapolation.

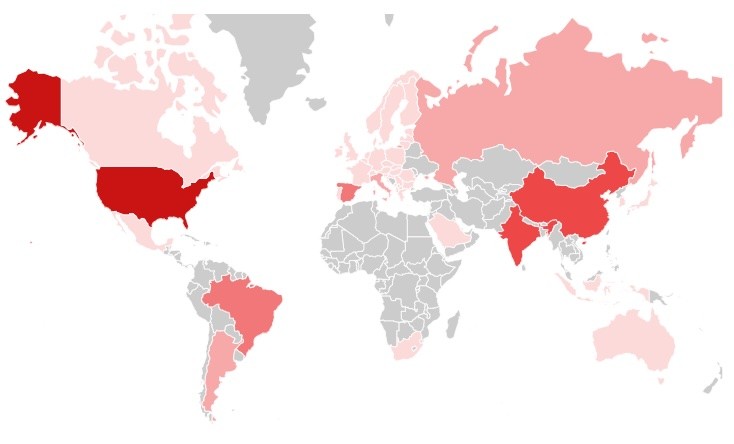

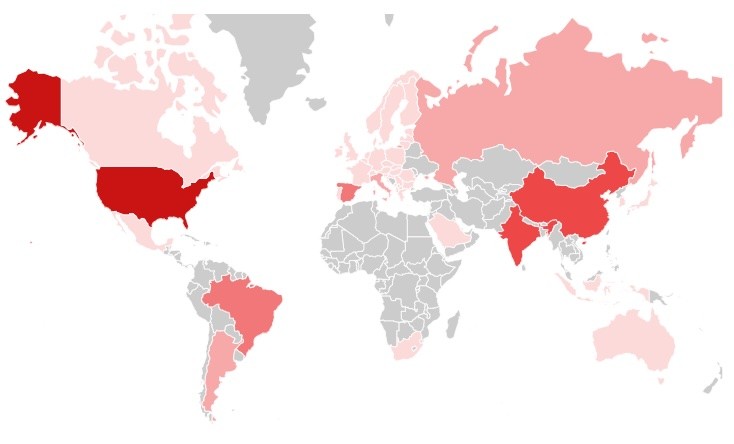

Global dependencies ranked 1, 2, and 3 in Venezuela in 2024

2. Exact scope of the study

This analysis does not seek to estimate:

losses in gross domestic product,

inflationary effects,

financial market reactions,

or government policy responses.

Its purpose is more fundamental:

to measure the structural propagation of an exogenous shock through global value chains, as they actually exist.

In other words, the analysis seeks to determine:

which countries are directly exposed to Venezuela,

how this exposure is transmitted to other countries through economic relationships,

and whether certain territories, particularly within the European Union, act as amplifiers or relays of the shock.

3. Data sources used

Two distinct families of data are mobilized.

3.1 Venezuelan international trade data

The starting point relies on observed Venezuelan customs data, describing exports:

by partner country,

by type of product,

with effective monetary values.

These data constitute the real, observed initial shock, without any modeling or assumption.

3.2 FIGARO input–output tables (Eurostat)

Shock propagation is modeled using the international input–output tables FIGARO, published by Eurostat.

These tables describe, for each country and each economic sector:

which products are used,

by which industries,

and for which purposes (final consumption, investment, exports, etc.).

They currently represent one of the most comprehensive statistical foundations for analyzing international economic interdependencies.

4. General methodology: a three-layer structural stress test

The analysis relies on a structural stress test, organized into three successive layers, labeled R1, R2, and R3.

It is important to emphasize that:

each layer is entirely derived from the previous one,

results are normalized at every step,

no arbitrary coefficients or behavioral parameters are introduced.

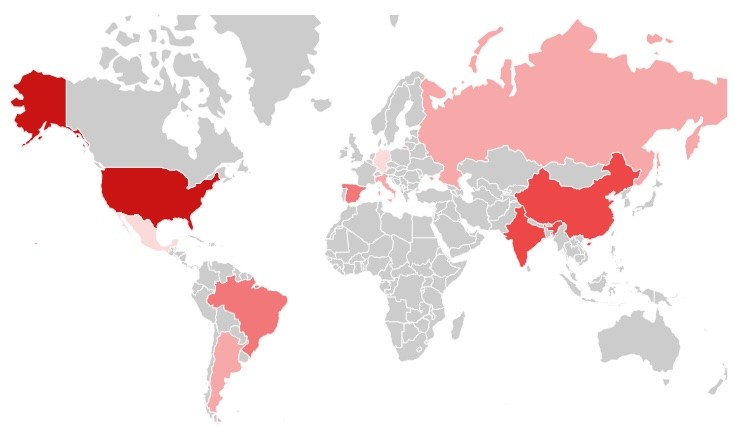

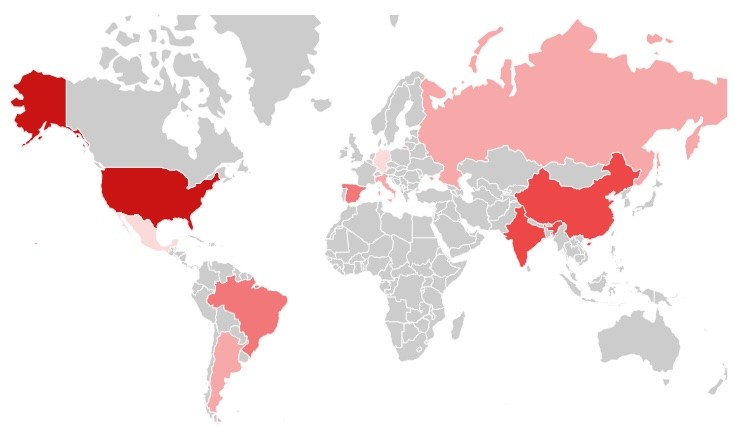

5. Rank 1 : Direct exposure to the Venezuelan shock

Dependencies rank 1 in Venezuela in 2024

5.1 Principle

The first layer, R1, measures direct exposure to Venezuela.

Concretely, it answers the question: which countries actually import goods from Venezuela, and in what proportions?

Venezuelan export flows are aggregated by:

partner country,

product category.

Each country is then assigned a relative weight, corresponding to its share of total observed exports.

5.2 Global results

The results show a very strong concentration of the initial shock:

the United States,

India,

China,

absorb the majority of direct exposure.

This concentration indicates that Venezuela is economically connected, in trade terms, to a limited number of major partners.

5.3 European Union position in R1

From a European perspective, direct exposure is limited and fragmented.

Some countries appear:

Spain in a noticeable way,

Italy and Germany more marginally.

However:

the majority of European Union member states show near-zero exposure,

no EU country appears among the main recipients of the initial shock.

The products concerned are primarily:

refined petroleum products,

and some agricultural products.

This means that, from the outset, the European Union is not a major entry point for the Venezuelan shock.

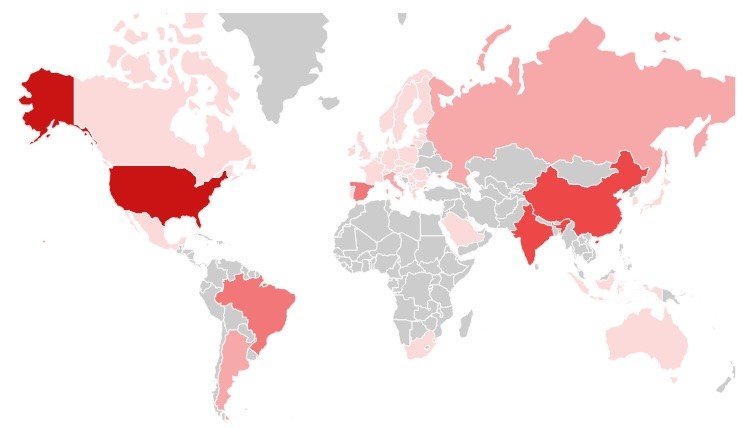

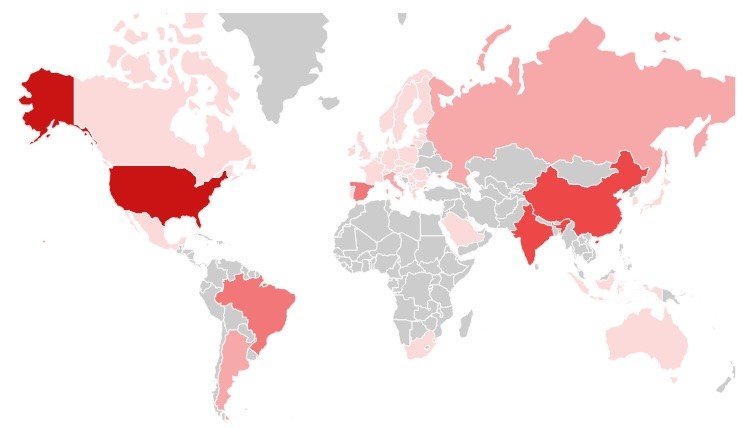

6. Rank 2 : First indirect propagation: from products to economic uses

Dependencies rank 2 in Venezuela in 2024

6.1 Principle

The second layer, R2, measures indirect propagation.

The logic is straightforward:

a country directly exposed in R1 does not absorb the shock in isolation; it transmits it to its own economic clients, according to the actual structure of its economy.

This transmission is measured using the FIGARO input–output tables, which describe:

how imported products are used,

by which sectors,

and for which final uses.

6.2 Nature of the observed propagation

In R2, the nature of the shock changes.

It is no longer expressed primarily in terms of imported products, but in terms of economic functions, such as:

household final consumption,

land transport and logistics,

the agri-food industry,

public services and infrastructure.

In other words, the shock moves from the realm of foreign trade into the real economy.

6.3 European Union in R2

Some European countries remain visible:

Spain,

Italy,

and to a lesser extent Germany.

However, their weights remain limited, and no European Union country becomes a central node of propagation.

France does not appear among the countries significantly affected at this stage.

This indicates that, even indirectly, the European Union receives the shock without relaying it in a meaningful way.

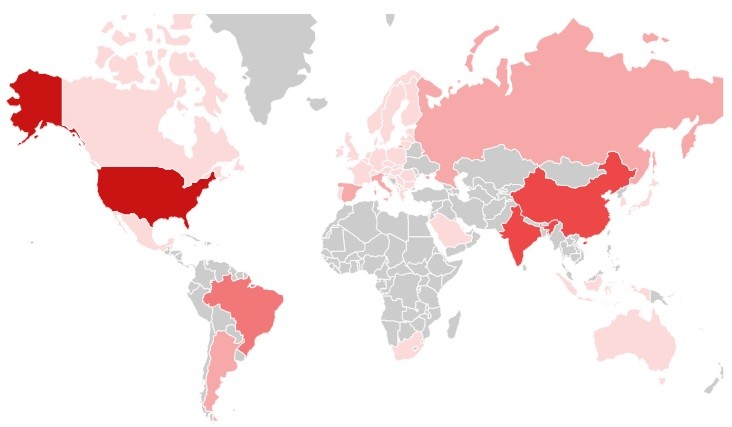

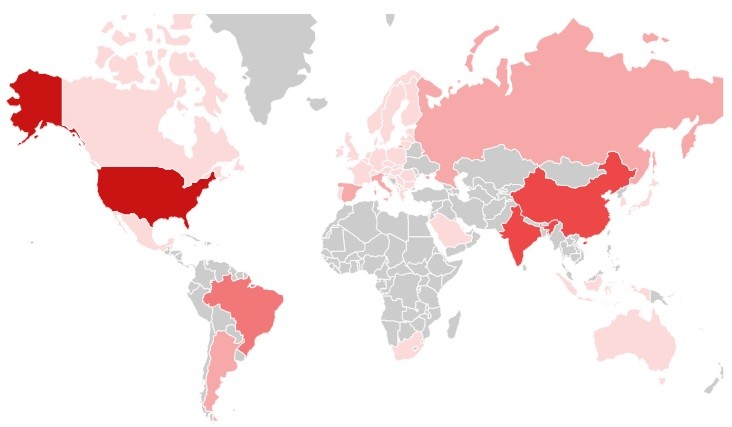

7. Rank 3 : Second indirect propagation: network effects

Dependencies rank 3 in Venezuela in 2024

7.1 Principle

The third layer, R3, applies exactly the same mechanism as R2, but starting from the sectors affected in R2.

It captures economic network effects, meaning the way a shock can circulate through multiple successive layers of productive relationships.

7.2 Global results

In R3, the structure of the shock stabilizes:

the same major countries remain dominant,

sectors related to food, transport, and infrastructure remain central.

There is no generalized dispersion or runaway amplification.

7.3 European Union in R3

The result is particularly clear for the European Union.

In R3:

no EU country appears as a structuring node,

European weights converge toward very low or zero values.

This means that:

European sectors affected do not retransmit the shock further,

the European Union does not act as an economic amplifier.

8. Overall reading

For the shock analyzed, the European Union appears:

weakly exposed directly,

moderately affected indirectly,

non-propagative at the network level.

This configuration does not imply general resilience, but rather reflects a specific structural position within the value chains concerned, which are dominated by energy, consumption, and transport outside Europe.

9. Limits of the analysis

This study does not account for:

political or industrial responses,

supplier substitution,

price or inventory effects,

temporal dynamics.

It is deliberately a structural stress test, not a dynamic macroeconomic simulation.

10. Conclusion

This analysis shows that:

the economic impact of a geopolitical shock depends less on the event itself than on the structural position of countries within global productive networks.

In the Venezuelan case, the European Union appears structurally downstream, receiving a limited share of the shock and playing no relay role.

This type of analysis, grounded in observed data and real economic structures, allows policymakers and analysts to move beyond headline-driven interpretations and reason in terms of measurable, defensible economic dependencies.

We can apply this stress test algorithm to your business to better understand the direct and indirect impact of this news on your operations.

Contact us to learn more.

Economic Analyst Note

Structural propagation of a Venezuelan shock through the global economy

1. Context and motivation of the analysis

This January 2026, international news was marked by a major event in Venezuela.

President Nicolás Maduro was apprehended during an operation conducted by U.S. forces and is expected to appear before a federal court in New York, notably on charges related to drug trafficking and narcoterrorism.

Independently of any political or judicial assessment, this event raises a precise economic question:

To what extent can a political shock affecting a producing and exporting country propagate, mechanically, through the global economy?

More specifically:

What is the actual exposure of European Union countries to such a shock, once the observed economic structures are taken into account?

This note aims to answer these questions exclusively on the basis of data, without behavioral assumptions, forward-looking scenarios, or macroeconomic extrapolation.

Global dependencies ranked 1, 2, and 3 in Venezuela in 2024

2. Exact scope of the study

This analysis does not seek to estimate:

losses in gross domestic product,

inflationary effects,

financial market reactions,

or government policy responses.

Its purpose is more fundamental:

to measure the structural propagation of an exogenous shock through global value chains, as they actually exist.

In other words, the analysis seeks to determine:

which countries are directly exposed to Venezuela,

how this exposure is transmitted to other countries through economic relationships,

and whether certain territories, particularly within the European Union, act as amplifiers or relays of the shock.

3. Data sources used

Two distinct families of data are mobilized.

3.1 Venezuelan international trade data

The starting point relies on observed Venezuelan customs data, describing exports:

by partner country,

by type of product,

with effective monetary values.

These data constitute the real, observed initial shock, without any modeling or assumption.

3.2 FIGARO input–output tables (Eurostat)

Shock propagation is modeled using the international input–output tables FIGARO, published by Eurostat.

These tables describe, for each country and each economic sector:

which products are used,

by which industries,

and for which purposes (final consumption, investment, exports, etc.).

They currently represent one of the most comprehensive statistical foundations for analyzing international economic interdependencies.

4. General methodology: a three-layer structural stress test

The analysis relies on a structural stress test, organized into three successive layers, labeled R1, R2, and R3.

It is important to emphasize that:

each layer is entirely derived from the previous one,

results are normalized at every step,

no arbitrary coefficients or behavioral parameters are introduced.

5. Rank 1 : Direct exposure to the Venezuelan shock

Dependencies rank 1 in Venezuela in 2024

5.1 Principle

The first layer, R1, measures direct exposure to Venezuela.

Concretely, it answers the question: which countries actually import goods from Venezuela, and in what proportions?

Venezuelan export flows are aggregated by:

partner country,

product category.

Each country is then assigned a relative weight, corresponding to its share of total observed exports.

5.2 Global results

The results show a very strong concentration of the initial shock:

the United States,

India,

China,

absorb the majority of direct exposure.

This concentration indicates that Venezuela is economically connected, in trade terms, to a limited number of major partners.

5.3 European Union position in R1

From a European perspective, direct exposure is limited and fragmented.

Some countries appear:

Spain in a noticeable way,

Italy and Germany more marginally.

However:

the majority of European Union member states show near-zero exposure,

no EU country appears among the main recipients of the initial shock.

The products concerned are primarily:

refined petroleum products,

and some agricultural products.

This means that, from the outset, the European Union is not a major entry point for the Venezuelan shock.

6. Rank 2 : First indirect propagation: from products to economic uses

Dependencies rank 2 in Venezuela in 2024

6.1 Principle

The second layer, R2, measures indirect propagation.

The logic is straightforward:

a country directly exposed in R1 does not absorb the shock in isolation; it transmits it to its own economic clients, according to the actual structure of its economy.

This transmission is measured using the FIGARO input–output tables, which describe:

how imported products are used,

by which sectors,

and for which final uses.

6.2 Nature of the observed propagation

In R2, the nature of the shock changes.

It is no longer expressed primarily in terms of imported products, but in terms of economic functions, such as:

household final consumption,

land transport and logistics,

the agri-food industry,

public services and infrastructure.

In other words, the shock moves from the realm of foreign trade into the real economy.

6.3 European Union in R2

Some European countries remain visible:

Spain,

Italy,

and to a lesser extent Germany.

However, their weights remain limited, and no European Union country becomes a central node of propagation.

France does not appear among the countries significantly affected at this stage.

This indicates that, even indirectly, the European Union receives the shock without relaying it in a meaningful way.

7. Rank 3 : Second indirect propagation: network effects

Dependencies rank 3 in Venezuela in 2024

7.1 Principle

The third layer, R3, applies exactly the same mechanism as R2, but starting from the sectors affected in R2.

It captures economic network effects, meaning the way a shock can circulate through multiple successive layers of productive relationships.

7.2 Global results

In R3, the structure of the shock stabilizes:

the same major countries remain dominant,

sectors related to food, transport, and infrastructure remain central.

There is no generalized dispersion or runaway amplification.

7.3 European Union in R3

The result is particularly clear for the European Union.

In R3:

no EU country appears as a structuring node,

European weights converge toward very low or zero values.

This means that:

European sectors affected do not retransmit the shock further,

the European Union does not act as an economic amplifier.

8. Overall reading

For the shock analyzed, the European Union appears:

weakly exposed directly,

moderately affected indirectly,

non-propagative at the network level.

This configuration does not imply general resilience, but rather reflects a specific structural position within the value chains concerned, which are dominated by energy, consumption, and transport outside Europe.

9. Limits of the analysis

This study does not account for:

political or industrial responses,

supplier substitution,

price or inventory effects,

temporal dynamics.

It is deliberately a structural stress test, not a dynamic macroeconomic simulation.

10. Conclusion

This analysis shows that:

the economic impact of a geopolitical shock depends less on the event itself than on the structural position of countries within global productive networks.

In the Venezuelan case, the European Union appears structurally downstream, receiving a limited share of the shock and playing no relay role.

This type of analysis, grounded in observed data and real economic structures, allows policymakers and analysts to move beyond headline-driven interpretations and reason in terms of measurable, defensible economic dependencies.

We can apply this stress test algorithm to your business to better understand the direct and indirect impact of this news on your operations.

Contact us to learn more.