Sovereignty Insights

Hungary 2023: Understanding the Foreign Dependencies Shaping Its Strategic Position

A data driven analysis of who Hungary depends on and why it matters for European sovereignty

Hungary is often described as one of the most open and export oriented economies in Central Europe. Its automotive clusters, its electronics assembly operations, and its manufacturing ecosystems make it deeply integrated into European and global value chains.

But like every modern economy, Hungary is defined not by what it produces, but by what it depends on.

This analysis uses the FIGARO 2023 input output framework to map the foreign dependencies of companies registered in Hungary. It identifies who buys from Hungary, who supplies Hungary, and where blind spots exist inside global supply chains.

It is the third chapter in our European series covering all 27 EU member states.

1. Hungary’s exposure to foreign demand

In 2023, companies registered in Hungary generated 191.3 billion euros in intermediate sales. A large portion of this activity depends on foreign buyers.

43.36% of Hungary’s revenue comes from abroad.

The breakdown is the following:

🇭🇺 Domestic market: 56.64%

🌍 Foreign markets: 43.36%

Inside the foreign share, the structure is:

🇪🇺 EU markets: 29.01%

🌍 Non EU markets: 14.35%

Hungary is therefore one of the most externally exposed economies in the EU. Its industrial performance is structurally linked to international demand, not occasionally but permanently.

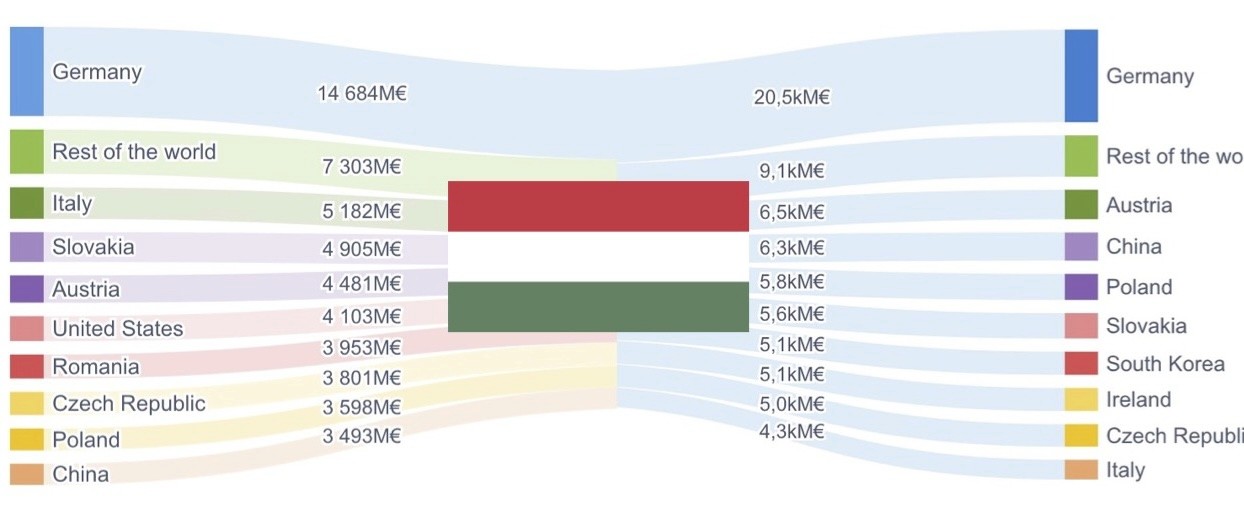

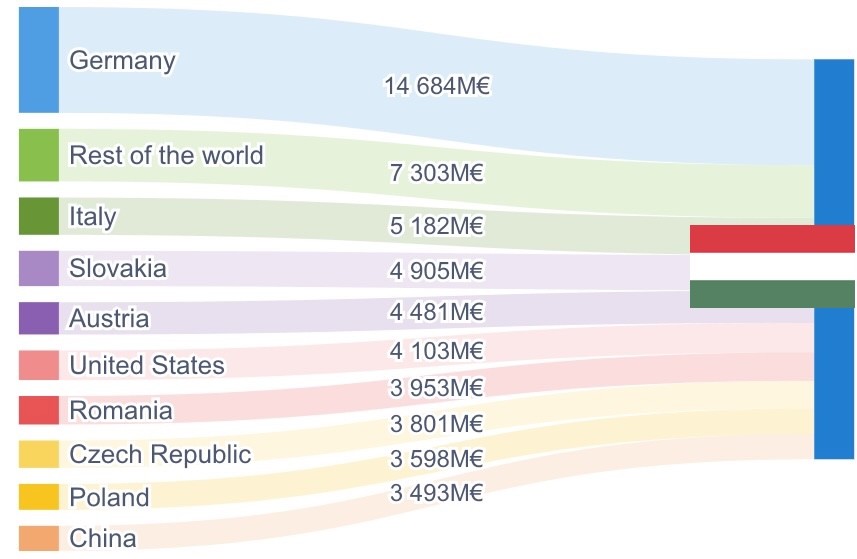

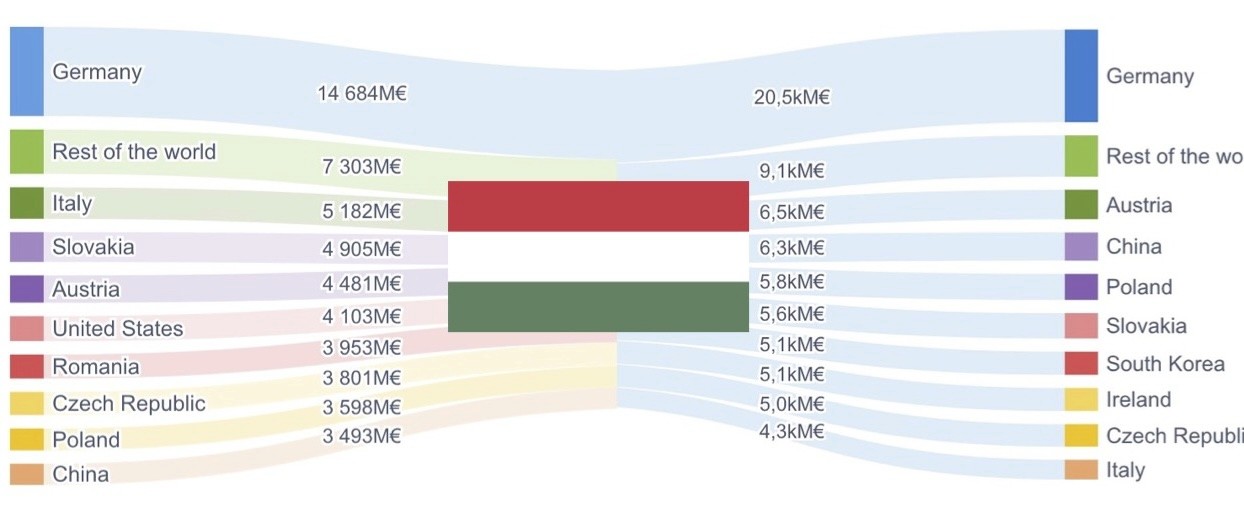

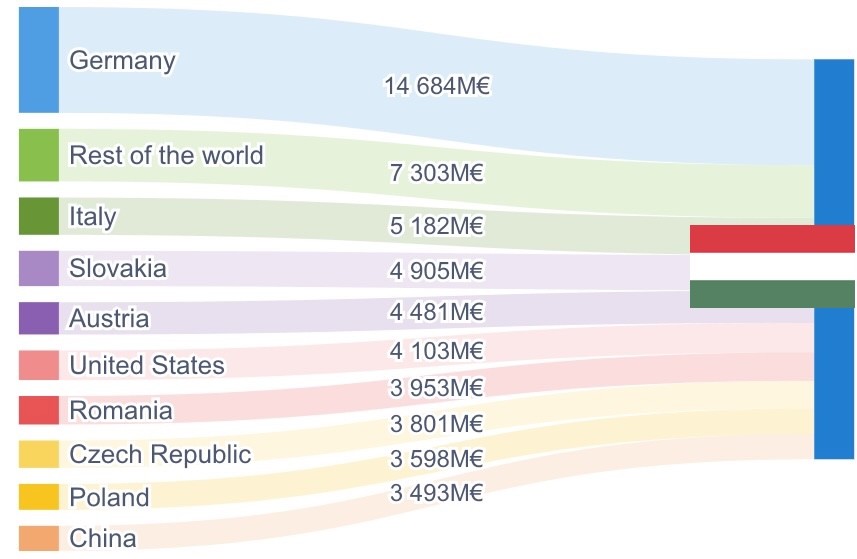

2. Who buys from Hungary: the real top clients

Hungary exported 82.9 billion euros of intermediate goods and services in 2023.

These are its most important foreign buyers:

Top 5 foreign clients of Hungary

🇩🇪 Germany – 7.68%

🏴 Rest of the World (FIGW1) – 3.82%

🇮🇹 Italy – 2.71%

🇸🇰 Slovakia – 2.56%

🇦🇹 Austria – 2.34%

The presence of Germany at the top is expected given Hungary’s integration in German automotive and manufacturing supply chains.

The presence of Rest of the World (FIGW1) is the real strategic finding.

Rest of the World is not a country nor a region. It is a statistical placeholder used when partner countries cannot be identified. It includes many economies, but identifies none of them.

Hungary therefore depends on foreign demand that cannot be attributed to any specific geographic partner. This is a visibility gap inside one of the most open economies in Europe.

3. Hungary’s exposure to foreign supply

On the input side, Hungary is even more exposed than on the demand side. In 2023, companies purchased 216.7 billion euros of intermediate goods.

50% of Hungary’s industrial inputs come from abroad.

The structure of these inputs is:

🇪🇺 EU suppliers: 32.82%

🌍 Non EU suppliers: 17.43%

Hungary is not only export oriented.

It is also structurally dependent on imported inputs to keep its industrial base running.

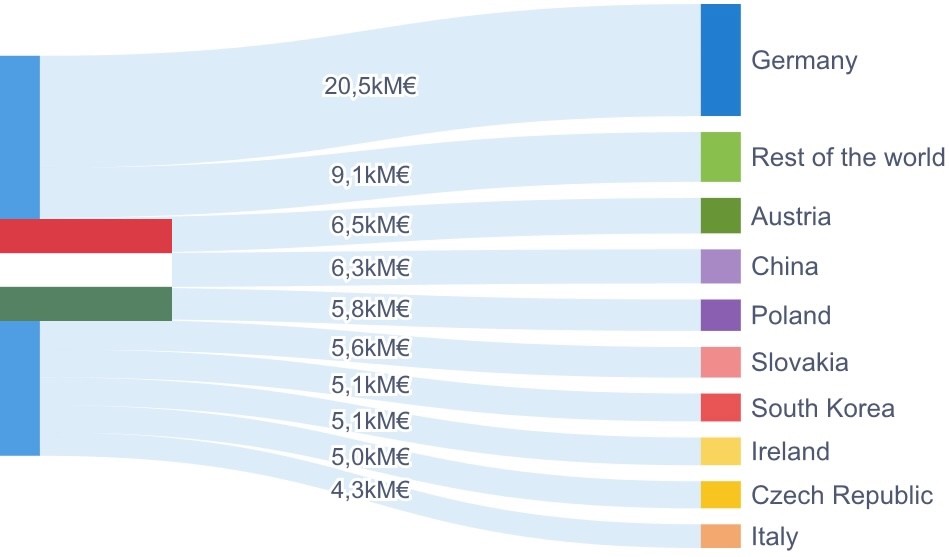

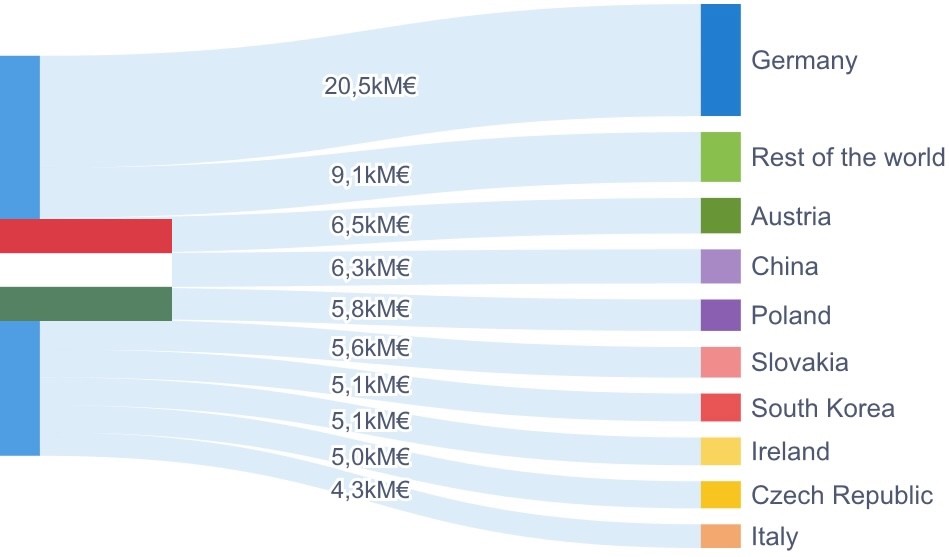

4. Who supplies Hungary: the top providers

These are the foreign suppliers that matter most to Hungarian production.

Top 5 foreign suppliers of Hungary

🇩🇪 Germany – 9.47%

🏴 Rest of the World (FIGW1) – 4.21%

🇦🇹 Austria – 3%

🇨🇳 China – 2.89%

🇵🇱 Poland – 2.66%

The structure is telling:

Germany remains central to Hungary’s industrial backbone

China plays a meaningful role in manufacturing and electronics

Neighboring EU economies support physical supply chains

And once again, Rest of the World appears near the top

This combination shows a mix of regional dependencies, global linkages, and a blind spot.

5. The FIGW1 problem: a blind spot in Hungary’s open economy

FIGW1 appears near the top on both sides:

Hungary’s foreign buyers

Hungary’s foreign suppliers

This is not a statistical curiosity.

It highlights a structural vulnerability: a share of Hungary’s economic exposure flows through unidentified actors. For a country that relies heavily on cross border production networks, this lack of visibility is significant.

Rest of the World hides:

logistics nodes

offshore suppliers

intermediaries

low transparency jurisdictions

multi tier supply chain contributors

These layers are outside the scope of traditional macroeconomic statistics.

Yet they shape Hungary’s economic resilience in times of stress.

6. Why these dependencies matter

Hungary is one of the most interconnected economies in Europe.

Interconnection is not a weakness. Opacity is.

Dependencies are manageable when they are visible.

They become risks when they remain hidden.

Hungary relies on foreign markets for 43% of its industrial revenue and on foreign suppliers for 50 percent of its inputs.

A part of this exposure is mapped. A part is not.

The invisible part is the one that makes the system vulnerable.

This is not only an economic topic. It is a sovereignty topic.

7. What Sentinel enables

Sentinel was designed to reveal what FIGW1 conceals.

It provides leaders with:

a clear map of foreign dependencies

a multi tier reconstruction of supply chains

identification of critical nodes

exposure levels by partner country

detection of blind spots in Rest of the World

Strategic sovereignty begins with visibility. No leader can manage what they cannot see.

8. Conclusion and next country

Hungary shows a distinct pattern:

high exposure to foreign demand

high exposure to foreign supply

a strong industrial dependency on Germany

significant activity flowing through Rest of the World

a structural visibility gap at the core of its economy

This is analysis 3 of 27.

The next country in our series will be Ireland 🇮🇪

Understanding dependencies is the first step to managing them.

The next analyses will continue to map Europe’s strategic exposure.

Follow-us here to receive every week the new analysis

Hungary is often described as one of the most open and export oriented economies in Central Europe. Its automotive clusters, its electronics assembly operations, and its manufacturing ecosystems make it deeply integrated into European and global value chains.

But like every modern economy, Hungary is defined not by what it produces, but by what it depends on.

This analysis uses the FIGARO 2023 input output framework to map the foreign dependencies of companies registered in Hungary. It identifies who buys from Hungary, who supplies Hungary, and where blind spots exist inside global supply chains.

It is the third chapter in our European series covering all 27 EU member states.

1. Hungary’s exposure to foreign demand

In 2023, companies registered in Hungary generated 191.3 billion euros in intermediate sales. A large portion of this activity depends on foreign buyers.

43.36% of Hungary’s revenue comes from abroad.

The breakdown is the following:

🇭🇺 Domestic market: 56.64%

🌍 Foreign markets: 43.36%

Inside the foreign share, the structure is:

🇪🇺 EU markets: 29.01%

🌍 Non EU markets: 14.35%

Hungary is therefore one of the most externally exposed economies in the EU. Its industrial performance is structurally linked to international demand, not occasionally but permanently.

2. Who buys from Hungary: the real top clients

Hungary exported 82.9 billion euros of intermediate goods and services in 2023.

These are its most important foreign buyers:

Top 5 foreign clients of Hungary

🇩🇪 Germany – 7.68%

🏴 Rest of the World (FIGW1) – 3.82%

🇮🇹 Italy – 2.71%

🇸🇰 Slovakia – 2.56%

🇦🇹 Austria – 2.34%

The presence of Germany at the top is expected given Hungary’s integration in German automotive and manufacturing supply chains.

The presence of Rest of the World (FIGW1) is the real strategic finding.

Rest of the World is not a country nor a region. It is a statistical placeholder used when partner countries cannot be identified. It includes many economies, but identifies none of them.

Hungary therefore depends on foreign demand that cannot be attributed to any specific geographic partner. This is a visibility gap inside one of the most open economies in Europe.

3. Hungary’s exposure to foreign supply

On the input side, Hungary is even more exposed than on the demand side. In 2023, companies purchased 216.7 billion euros of intermediate goods.

50% of Hungary’s industrial inputs come from abroad.

The structure of these inputs is:

🇪🇺 EU suppliers: 32.82%

🌍 Non EU suppliers: 17.43%

Hungary is not only export oriented.

It is also structurally dependent on imported inputs to keep its industrial base running.

4. Who supplies Hungary: the top providers

These are the foreign suppliers that matter most to Hungarian production.

Top 5 foreign suppliers of Hungary

🇩🇪 Germany – 9.47%

🏴 Rest of the World (FIGW1) – 4.21%

🇦🇹 Austria – 3%

🇨🇳 China – 2.89%

🇵🇱 Poland – 2.66%

The structure is telling:

Germany remains central to Hungary’s industrial backbone

China plays a meaningful role in manufacturing and electronics

Neighboring EU economies support physical supply chains

And once again, Rest of the World appears near the top

This combination shows a mix of regional dependencies, global linkages, and a blind spot.

5. The FIGW1 problem: a blind spot in Hungary’s open economy

FIGW1 appears near the top on both sides:

Hungary’s foreign buyers

Hungary’s foreign suppliers

This is not a statistical curiosity.

It highlights a structural vulnerability: a share of Hungary’s economic exposure flows through unidentified actors. For a country that relies heavily on cross border production networks, this lack of visibility is significant.

Rest of the World hides:

logistics nodes

offshore suppliers

intermediaries

low transparency jurisdictions

multi tier supply chain contributors

These layers are outside the scope of traditional macroeconomic statistics.

Yet they shape Hungary’s economic resilience in times of stress.

6. Why these dependencies matter

Hungary is one of the most interconnected economies in Europe.

Interconnection is not a weakness. Opacity is.

Dependencies are manageable when they are visible.

They become risks when they remain hidden.

Hungary relies on foreign markets for 43% of its industrial revenue and on foreign suppliers for 50 percent of its inputs.

A part of this exposure is mapped. A part is not.

The invisible part is the one that makes the system vulnerable.

This is not only an economic topic. It is a sovereignty topic.

7. What Sentinel enables

Sentinel was designed to reveal what FIGW1 conceals.

It provides leaders with:

a clear map of foreign dependencies

a multi tier reconstruction of supply chains

identification of critical nodes

exposure levels by partner country

detection of blind spots in Rest of the World

Strategic sovereignty begins with visibility. No leader can manage what they cannot see.

8. Conclusion and next country

Hungary shows a distinct pattern:

high exposure to foreign demand

high exposure to foreign supply

a strong industrial dependency on Germany

significant activity flowing through Rest of the World

a structural visibility gap at the core of its economy

This is analysis 3 of 27.

The next country in our series will be Ireland 🇮🇪

Understanding dependencies is the first step to managing them.

The next analyses will continue to map Europe’s strategic exposure.

Follow-us here to receive every week the new analysis