Sovereignty Insights

Germany 2023: Understanding the Strategic Foreign Dependencies of Its Companies

Germany is often seen as the industrial backbone of Europe. Its export power, its manufacturing base, its global brands, and its supply chain reach all reinforce the perception of a country that controls its economic destiny.

A data driven analysis of who Germany depends on and why it matters for European sovereignty

Germany is often seen as the industrial backbone of Europe. Its export power, its manufacturing base, its global brands, and its supply chain reach all reinforce the perception of a country that controls its economic destiny.

But like every modern economy, Germany is not defined by what it produces. It is defined by what it depends on.

This analysis uses the FIGARO 2023 input output framework to map the foreign dependencies of companies registered in Germany. It highlights who buys from Germany, who supplies Germany, and where blind spots exist inside global value chains.

It is the second chapter in our European series, covering all 27 EU member states.

1. Germany’s exposure to foreign demand

Companies registered in Germany generated 4,350 billion euros in intermediate sales in 2023.

A significant share of this value does not come from inside the country.

21% of Germany’s revenue comes from abroad.

The breakdown is the following:

🇩🇪 Domestic market: 78.95%

🌍 Foreign markets: 21.05%

Inside this foreign share, the split is almost even:

🇪🇺 EU markets: 11.54%

🌍 Non EU markets: 9.51%

Foreign demand is therefore a structural component of German industrial activity. The country depends on international markets not occasionally, but as part of its normal operating baseline.

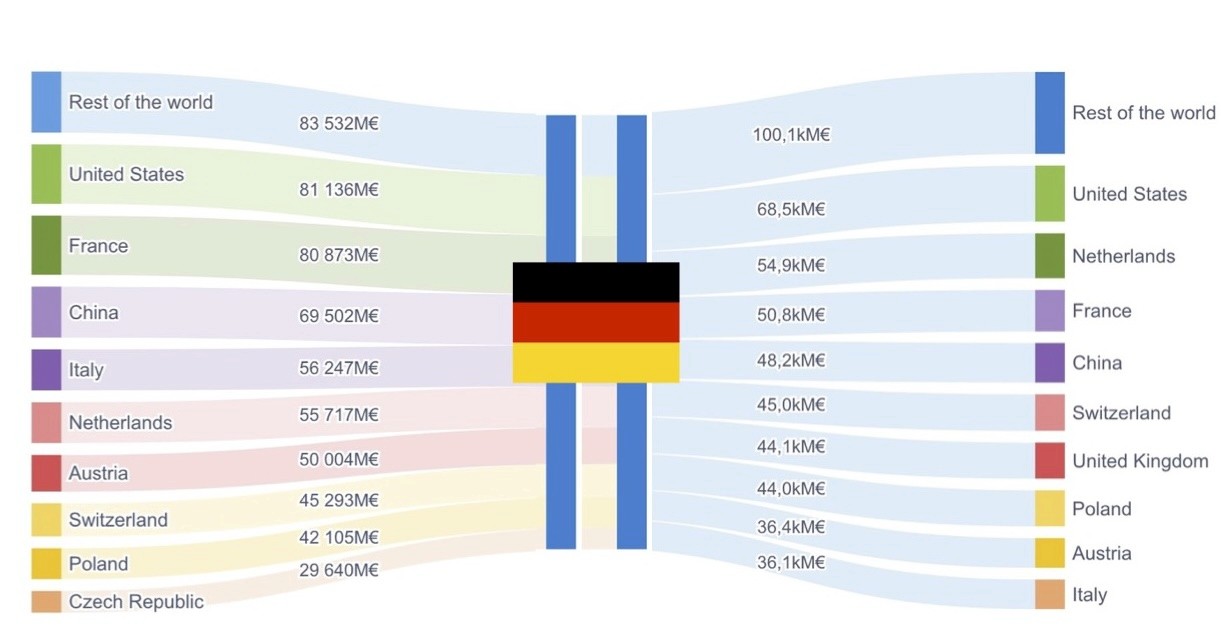

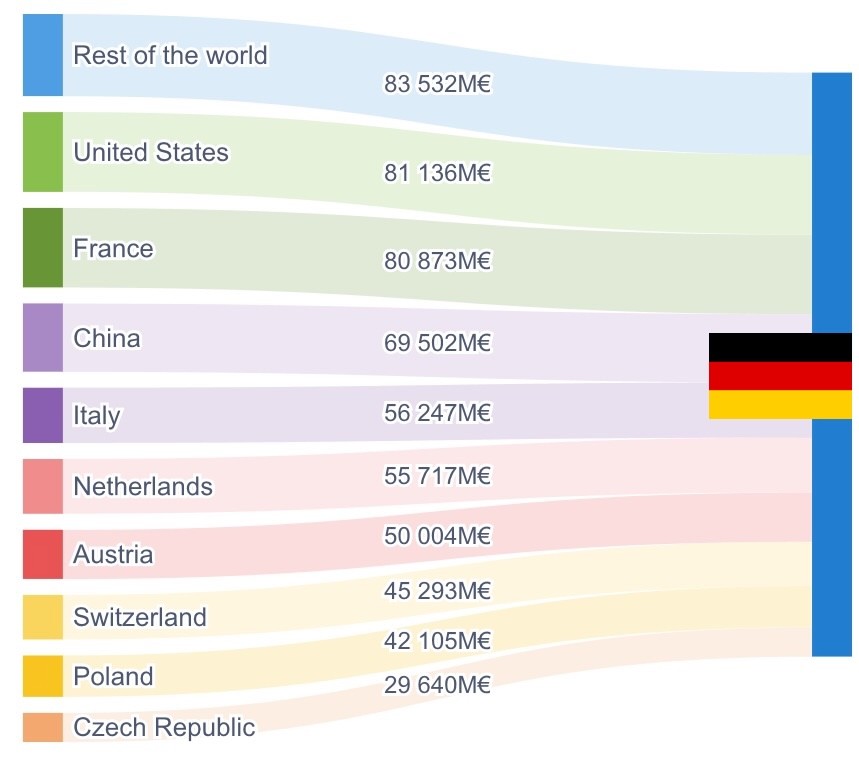

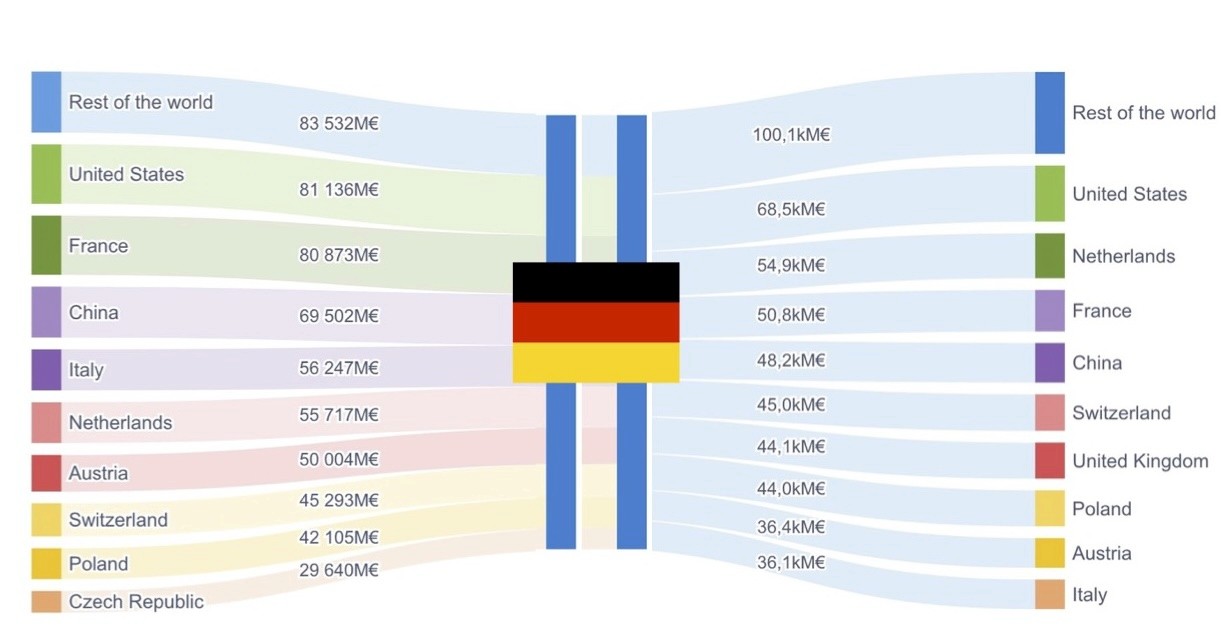

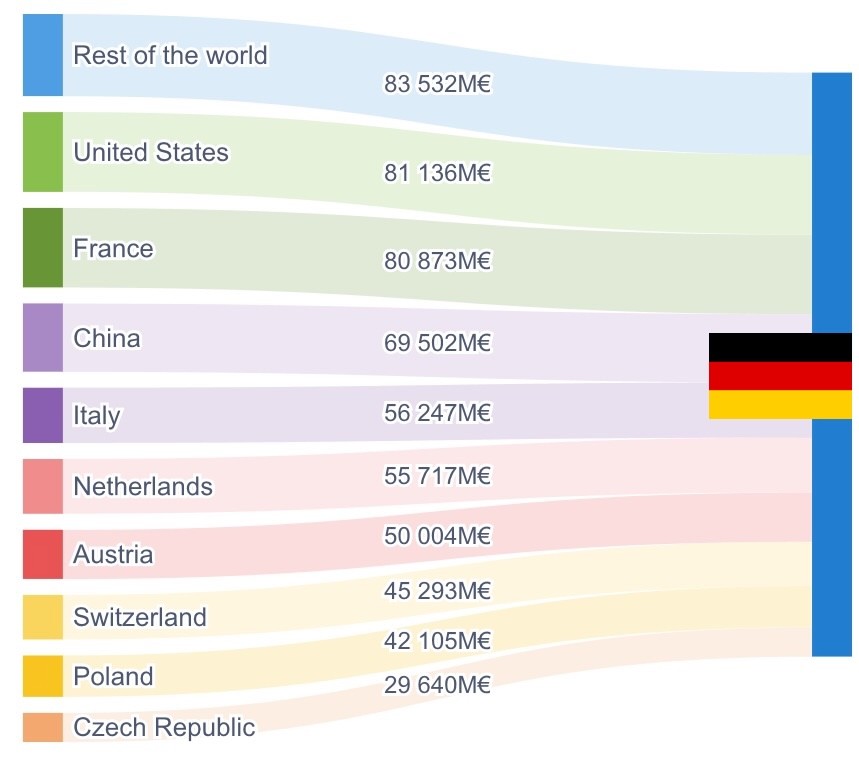

2. Who buys from Germany: the real top clients

Germany exported 915.7 billion euros worth of intermediate goods and services in 2023. Here are the five foreign buyers that matter the most.

Top 5 foreign clients of Germany :

🏴 Rest of the World (FIGW1) 1.92%

🇺🇸 United States 1.87%

🇫🇷 France 1.86%

🇨🇳 China 1.6%

🇮🇹 Italy 1.29%

The United States, France, China, and Italy are expected partners. The presence of Rest of the World at the top is the real finding.

Rest of the World is not a region or a geopolitical bloc. It is the statistical container used when a dataset cannot assign a partner country. It includes many countries, but lists none of them.

Germany is therefore exposed to a share of foreign demand that it cannot attribute to identifiable partners. For a leading industrial power, this is a structural blind spot.

3. Germany’s exposure to foreign supply

On the input side, the picture is similar. German companies purchased 4,261 billion euros of intermediate goods in 2023. A significant part of these inputs comes from abroad.

19% of all German industrial inputs come from foreign suppliers.

The structure of these foreign inputs is:

🇪🇺 EU suppliers: 9.89%

🌍 Non EU suppliers: 9.51%

Foreign supply is almost perfectly balanced between EU and non EU partners, which means Germany does not rely on a single economic bloc for its supply security.

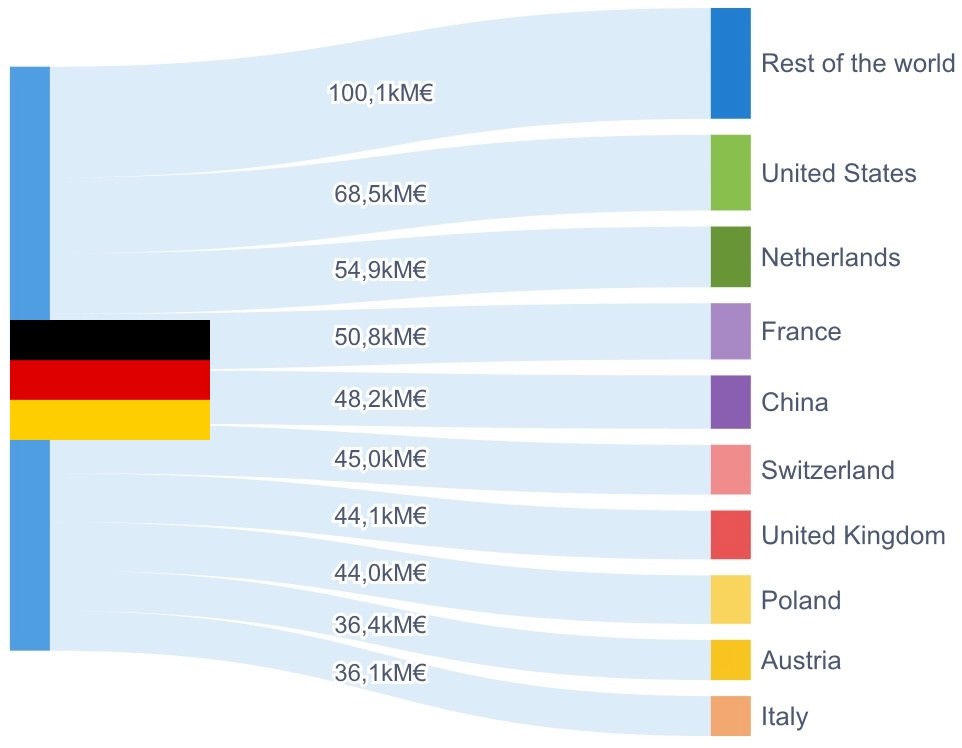

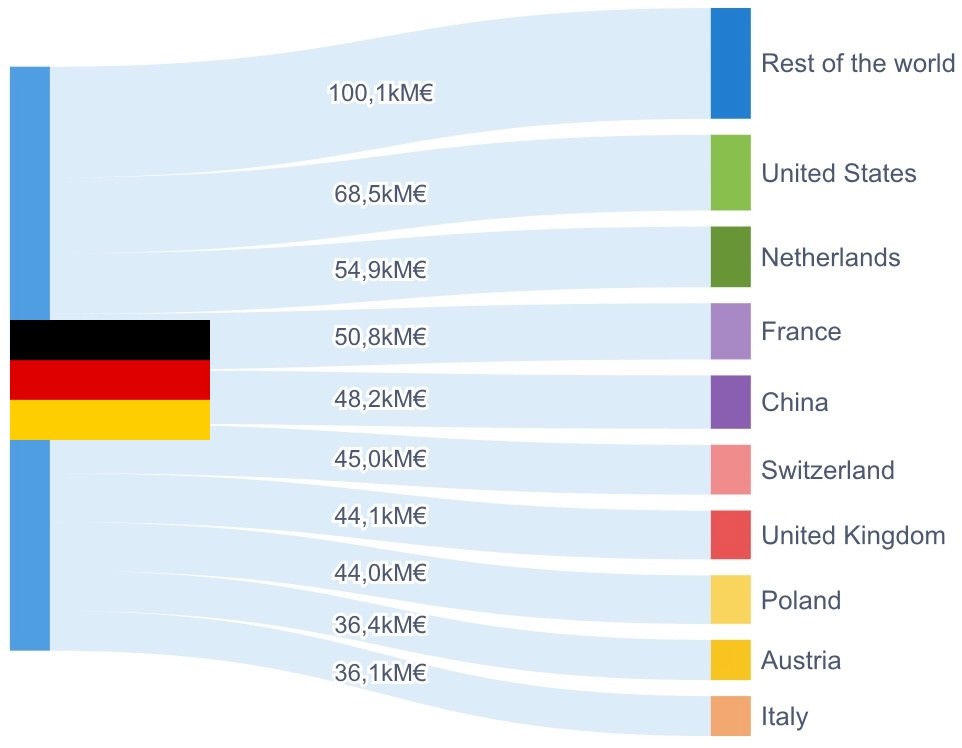

4. Who supplies Germany: the top providers

Here are the five foreign suppliers with the greatest weight in Germany’s input structure.

Top 5 foreign suppliers of Germany

🏴 Rest of the World (FIGW1) 2.35%

🇺🇸 United States 1.61%

🇳🇱 Netherlands 1.29%

🇫🇷 France 1.19%

🇨🇳 China 1.13%

Germany’s supply chain reflects a mix of EU neighbors, global manufacturing centers, and a non identified block that remains opaque.

Again, Rest of the World appears as the number one foreign supplier.

This is not a coincidence. It is a structural limitation of all international input output datasets.

5. The FIGW1 problem: a blind spot inside Europe’s largest industrial system

FIGW1, Rest of the World, appears at the top of both lists:

Top foreign clients

Top foreign suppliers

This means that the German economy relies on flows that are not assigned to individual countries. For policymakers, this represents an analytical gap. For companies, it represents an exposure they do not know how to quantify.

Rest of the World is not a minor detail. It is where risk accumulates when no one is looking.

It hides supply chain nodes that cannot be monitored, stress tested, or integrated into risk models.

For a country with the industrial weight of Germany, this is not only a statistical issue. It is a sovereignty issue.

6. Why these dependencies matter

Germany is one of the most interconnected economies on the planet.

Interconnection is not the problem. Opacity is.

Dependencies are not dangerous because they exist.

They are dangerous when leaders cannot see them clearly.

A dependency you can see is a dependency you can manage.

A dependency you cannot see is a bet you do not control.

21% of German revenue and 19% of German industrial inputs depend on foreign actors.

A part of this exposure is mapped. A part is not.

The invisible part is the one that matters most.

7. What Sentinel enables

The role of Sentinel is to reveal the dependencies that remain hidden in FIGW1 and other aggregated data sources.

It allows leaders to understand:

who they rely on

how deeply

through which chains

and with what level of risk

This is the operational foundation of strategic sovereignty.

It is not about producing everything domestically.

It is about knowing exactly where vulnerabilities originate and how they propagate through multi tiered value chains.

8. Conclusion and next country

Germany shows a clear pattern that we will observe in other EU economies.

A visible set of partners.

A hidden block of flows.

A structural dependence on foreign demand and foreign supply.

A part of the value chain that remains uncharted.

This is analysis number 2 / 27.

The next country in the series will be Hungary 🇭🇺

Understanding dependencies is the first step to managing them.

The next twenty five analyses will continue to build the European map of strategic exposure.

Follow-us here to receive every week the new analysis

A data driven analysis of who Germany depends on and why it matters for European sovereignty

Germany is often seen as the industrial backbone of Europe. Its export power, its manufacturing base, its global brands, and its supply chain reach all reinforce the perception of a country that controls its economic destiny.

But like every modern economy, Germany is not defined by what it produces. It is defined by what it depends on.

This analysis uses the FIGARO 2023 input output framework to map the foreign dependencies of companies registered in Germany. It highlights who buys from Germany, who supplies Germany, and where blind spots exist inside global value chains.

It is the second chapter in our European series, covering all 27 EU member states.

1. Germany’s exposure to foreign demand

Companies registered in Germany generated 4,350 billion euros in intermediate sales in 2023.

A significant share of this value does not come from inside the country.

21% of Germany’s revenue comes from abroad.

The breakdown is the following:

🇩🇪 Domestic market: 78.95%

🌍 Foreign markets: 21.05%

Inside this foreign share, the split is almost even:

🇪🇺 EU markets: 11.54%

🌍 Non EU markets: 9.51%

Foreign demand is therefore a structural component of German industrial activity. The country depends on international markets not occasionally, but as part of its normal operating baseline.

2. Who buys from Germany: the real top clients

Germany exported 915.7 billion euros worth of intermediate goods and services in 2023. Here are the five foreign buyers that matter the most.

Top 5 foreign clients of Germany :

🏴 Rest of the World (FIGW1) 1.92%

🇺🇸 United States 1.87%

🇫🇷 France 1.86%

🇨🇳 China 1.6%

🇮🇹 Italy 1.29%

The United States, France, China, and Italy are expected partners. The presence of Rest of the World at the top is the real finding.

Rest of the World is not a region or a geopolitical bloc. It is the statistical container used when a dataset cannot assign a partner country. It includes many countries, but lists none of them.

Germany is therefore exposed to a share of foreign demand that it cannot attribute to identifiable partners. For a leading industrial power, this is a structural blind spot.

3. Germany’s exposure to foreign supply

On the input side, the picture is similar. German companies purchased 4,261 billion euros of intermediate goods in 2023. A significant part of these inputs comes from abroad.

19% of all German industrial inputs come from foreign suppliers.

The structure of these foreign inputs is:

🇪🇺 EU suppliers: 9.89%

🌍 Non EU suppliers: 9.51%

Foreign supply is almost perfectly balanced between EU and non EU partners, which means Germany does not rely on a single economic bloc for its supply security.

4. Who supplies Germany: the top providers

Here are the five foreign suppliers with the greatest weight in Germany’s input structure.

Top 5 foreign suppliers of Germany

🏴 Rest of the World (FIGW1) 2.35%

🇺🇸 United States 1.61%

🇳🇱 Netherlands 1.29%

🇫🇷 France 1.19%

🇨🇳 China 1.13%

Germany’s supply chain reflects a mix of EU neighbors, global manufacturing centers, and a non identified block that remains opaque.

Again, Rest of the World appears as the number one foreign supplier.

This is not a coincidence. It is a structural limitation of all international input output datasets.

5. The FIGW1 problem: a blind spot inside Europe’s largest industrial system

FIGW1, Rest of the World, appears at the top of both lists:

Top foreign clients

Top foreign suppliers

This means that the German economy relies on flows that are not assigned to individual countries. For policymakers, this represents an analytical gap. For companies, it represents an exposure they do not know how to quantify.

Rest of the World is not a minor detail. It is where risk accumulates when no one is looking.

It hides supply chain nodes that cannot be monitored, stress tested, or integrated into risk models.

For a country with the industrial weight of Germany, this is not only a statistical issue. It is a sovereignty issue.

6. Why these dependencies matter

Germany is one of the most interconnected economies on the planet.

Interconnection is not the problem. Opacity is.

Dependencies are not dangerous because they exist.

They are dangerous when leaders cannot see them clearly.

A dependency you can see is a dependency you can manage.

A dependency you cannot see is a bet you do not control.

21% of German revenue and 19% of German industrial inputs depend on foreign actors.

A part of this exposure is mapped. A part is not.

The invisible part is the one that matters most.

7. What Sentinel enables

The role of Sentinel is to reveal the dependencies that remain hidden in FIGW1 and other aggregated data sources.

It allows leaders to understand:

who they rely on

how deeply

through which chains

and with what level of risk

This is the operational foundation of strategic sovereignty.

It is not about producing everything domestically.

It is about knowing exactly where vulnerabilities originate and how they propagate through multi tiered value chains.

8. Conclusion and next country

Germany shows a clear pattern that we will observe in other EU economies.

A visible set of partners.

A hidden block of flows.

A structural dependence on foreign demand and foreign supply.

A part of the value chain that remains uncharted.

This is analysis number 2 / 27.

The next country in the series will be Hungary 🇭🇺

Understanding dependencies is the first step to managing them.

The next twenty five analyses will continue to build the European map of strategic exposure.

Follow-us here to receive every week the new analysis